- Get link

- Other Apps

- Get link

- Other Apps

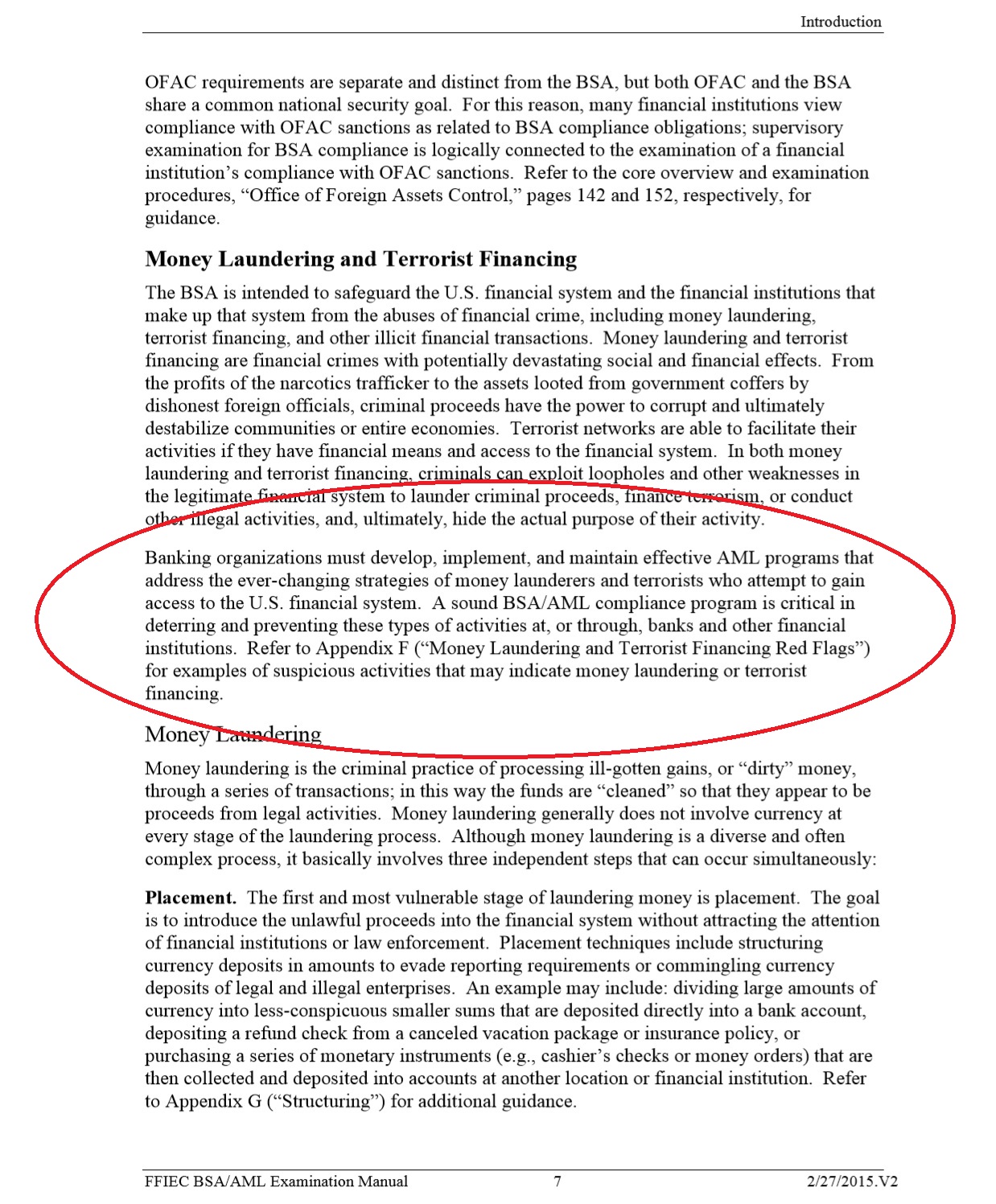

The concept of money laundering is essential to be understood for these working within the monetary sector. It's a course of by which soiled cash is transformed into clean money. The sources of the money in precise are felony and the cash is invested in a way that makes it appear like clean cash and conceal the id of the felony part of the cash earned.

While executing the monetary transactions and establishing relationship with the new prospects or maintaining existing prospects the responsibility of adopting sufficient measures lie on each one who is part of the organization. The identification of such element in the beginning is simple to cope with as an alternative realizing and encountering such situations later on in the transaction stage. The central financial institution in any nation supplies complete guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously provide sufficient security to the banks to discourage such situations.

Services include transaction monitoring alert backlog. In order for the Bank Secrecy Act regulations and the Bank Secrecy Act training to help prevent money laundering in the financial industry the Act requires all financial institution to maintain detailed records regarding cash purchases as well as file reports regarding cash purchase of negotiable instruments that are no less than 10000.

Decoding Updates To The Bank Secrecy Act Anti Money Laundering Examination Manual

15 - Bank Staff.

Bank secrecy act canada. 1 - Short Title. The intergovernmental agreement between Canada and the US. Among the topics considered are the following.

Title I Financial Recordkeeping and Title II Reports of Currency and Foreign Transactions. 18 - Business and Powers of the Bank. 14 - Government Directive.

5311 et seq is referred to as the Bank Secrecy Act BSA. Canada bank secrecy legal framework. 26 - Redemption of Notes Other than Those of the Bank.

25 - Note Issue and Removal. 3 - Constitution of the Bank. Legislation aimed toward preventing criminals from using financial institutions to hide or launder money.

We provide highly trained AMLBSA professionals to assist banks and non-bank financial institutions to meet day-to-day compliance tasks. AML RightSource is the leading firm solely focused on Anti-Money Laundering AMLBank Secrecy Act BSA and financial crimes compliance solutions. The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC.

17 - Capital and Shares. Common law duties with respect to covered persons and entities protected customer data exceptions permitting disclosure. The Bank Secrecy Act.

The OCC prescribes regulations conducts supervisory activities and when necessary takes enforcement actions to ensure that national banks have the necessary controls in place and provide the requisite notices to law enforcement to deter and detect money laundering terrorist financing and other criminal acts and the misuse of our nations financial institutions. Fifty years after its birth the Bank Secrecy Act along with the long-forgotten role it played in breaking open the Watergate scandal continues to have an increasing influence on the financial. The Bank Secrecy Act BSA is US.

Bank of Canada Act. Title I authorized the Secretary of the Treasury to issue regulations which require insured financial institutions to maintain certain records. Department of the Treasury Financial Crimes Enforcement Network v 10 exeCutive summary Section 6302 of the Intelligence Reform and Terrorism Prevention Act of 20041 amended the Bank Secrecy Act BSA to require the Secretary of the Treasury to prescribe regulations requiring such financial institutions.

The OCC prescribes regulations conducts supervisory activities and when necessary takes enforcement actions to ensure that national banks have the necessary controls in place and provide the requisite notices to law enforcement to deter and detect money laundering terrorist financing and other criminal acts and the misuse of our nations financial institutions. And the international standard for the automatic exchange of financial account information between tax administrations also known as the Common Reporting Standard CRS are designed to improve tax compliance. 27 - Reserve Funds.

13 - Executive Committee. This publication provides guidance for banking institutions handling customer data in Canada. The law requires financial institutions to provide.

The BSA consists of two parts. Bank Secrecy alone has worked well for the end users for over forty years but under US law and the laws of other industrialized nations Japan UK Canada Australia it is income tax evasion a felony just having an offshore bank account and not reporting the income on ones tax return.

Http Www Ippapublicpolicy Org File Paper 593e4e1895440 Pdf

Anti Money Laundering Process In Banks

Pdf Still Keeping Secrets Bank Secrecy Money Laundering And Anti Money Laundering In Switzerland And Singapore

Anti Money Laundering Process In Banks

Finding Renewed Purpose In The Bank Secrecy Act Verafin

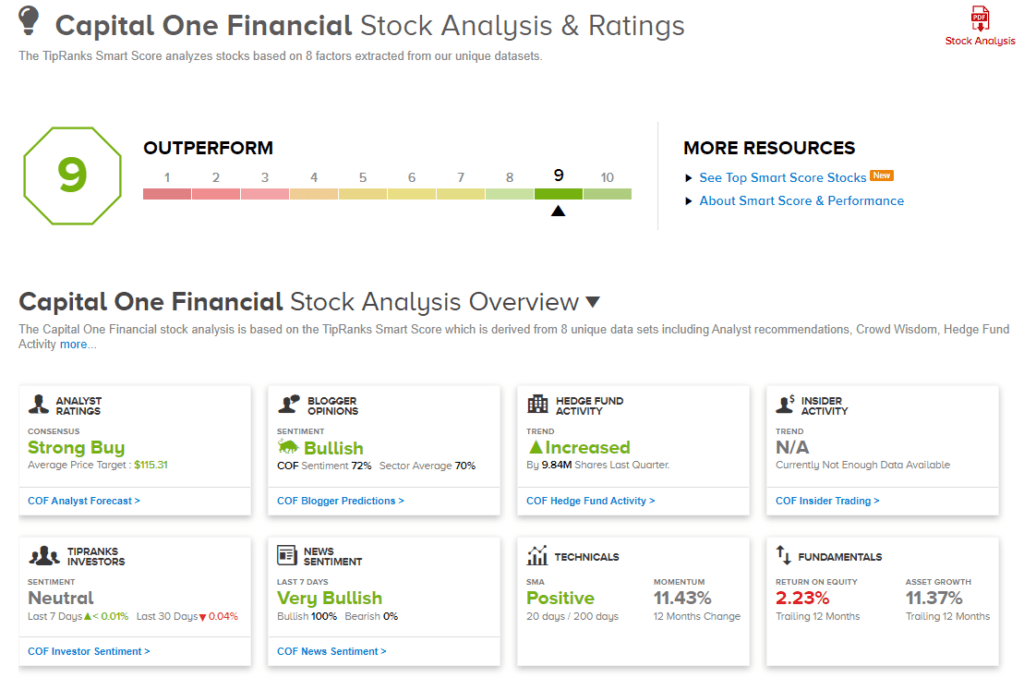

Capital One Fined 390m For Violating Bank Secrecy Act Nasdaq

Finding Renewed Purpose In The Bank Secrecy Act Verafin

Bank Secrecy Act Anti Money Laundering Examination Manual U S Government Bookstore

Bank Secrecy Act Anti Money Laundering Examination Manual U S Government Bookstore

Anti Money Laundering Process In Banks

Anti Money Laundering Process In Banks

Bank Secrecy Act Scefcu June 21 Ppt Download

Bsa Aml Risk Assessments And The Bank Secrecy Act Freed Maxick

Bank Secrecy Act Scefcu June 21 Ppt Download

The world of regulations can look like a bowl of alphabet soup at occasions. US cash laundering rules aren't any exception. We've got compiled a listing of the top ten money laundering acronyms and their definitions. TMP Risk is consulting firm focused on protecting monetary services by decreasing risk, fraud and losses. We have now massive financial institution expertise in operational and regulatory threat. We have a powerful background in program administration, regulatory and operational threat as well as Lean Six Sigma and Enterprise Course of Outsourcing.

Thus money laundering brings many adverse penalties to the group due to the risks it presents. It will increase the probability of major risks and the opportunity price of the bank and finally causes the financial institution to face losses.

Comments

Post a Comment