- Get link

- Other Apps

- Get link

- Other Apps

The idea of cash laundering is very important to be understood for these working in the financial sector. It is a course of by which soiled money is converted into clean cash. The sources of the money in precise are criminal and the money is invested in a approach that makes it appear like clear money and conceal the identity of the legal a part of the cash earned.

Whereas executing the financial transactions and establishing relationship with the brand new clients or sustaining present clients the responsibility of adopting enough measures lie on each one who is part of the organization. The identification of such component in the beginning is simple to deal with as a substitute realizing and encountering such situations later on in the transaction stage. The central financial institution in any nation supplies complete guides to AML and CFT to combat such actions. These polices when adopted and exercised by banks religiously present enough security to the banks to deter such situations.

The second phase is concealment. We have written an article how money laundering affects the financial system of a country in turn show the risks that are associated with this.

Corruption And Money Laundering The Nexus Way Forward

By its very nature money laundering is an illegal activity carried out by criminals which occurs outside of the normal range of economic and financial statistics.

Give definition of money laundering. Money laundering is a federal crime in which large sums of dirty currency earned from illegal activity such as drug or sex crimes is cleaned and deposited into a legally sanctioned banking institutions. The reasoning behind this is due to the fact that banks must report large or suspicious transactions to the IRS. Money Laundering meaning in law Money laundering is a term used to describe a scheme in which criminals try to disguise the identity original ownership and destination of money that they have obtained through criminal conduct.

Directly or indirectly attempted to. Money laundering works by transferring money in elaborate and complicated financial transactions which mislead anyone who. Money laundering is regarded as a process which consists of 3 phases.

Money Laundering is the process of changing the colors of the money. What is Money Laundering. Money Laundering is an act of act of disguising the illegal source of income.

This involves such things as transferring sums of money to various bank accounts in the Netherlands and abroad. Money Laundering impairs the sustainability and development of financial institutions in two ways. First the illegal activity that garners the money places it in the launderers hands.

The first phase is bringing the cash into the financial systems by depositing it in a bank account for example. Along with some other aspects of underground economic activity rough estimates have been. Money laundering is something some criminals do to hide the money they make from crimes.

Drug traffickers smugglers or people who are associated with criminal organizations use different modalities to launder money and prove their profits as legal to evade the authorities. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. Offence of Money Laundering.

Criminals do money laundering to make it hard for the police to find out where the criminal got the money. Money laundering refers to a financial transaction scheme that aims to conceal the identity source and destination of illicitly-obtained money. Criminals use money laundering to conceal their crimes and the money derived from them.

What is Money Laundering. The money laundering process can be broken down into three stages. Anti Money Laundering AML seeks to deter criminals by making it harder for them to hide ill-gotten money.

Money laundering has been defined in the Prevention of Money Laundering Act of 2002 PMLA under section 3 where a person shall be guilty of the offence if such person is found to have. Basically different money launderers gain money from illegal sources and try to convert it into legitimate by using different ways. Its very easy to define but involves multiple techniques.

It is a worldwide problem with approximately 300 billion going through the. Laundering allows criminals to transform illegally obtained gain into seemingly legitimate funds. By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to appear as legitimate business profits.

Money laundering is a way to conceal illegally obtained funds. Money laundering definition is studied from wide verity perspectives but generally it includes the conversion or transfer of capital knowing that the capital is the result of a crime in order to conceal the illegal origin and nature of the capital. The crime of moving money that has been obtained illegally through banks and other businesses to.

The process of taking the proceeds of criminal activity and making them appear legal. The laundering is done with the intention of making it seem that the proceeds have come from a legitimate source. Firstly the financial institutions are weakened directly through money laundering as there seems to be a correlation between money laundering and fraudulent activities undertaken by.

Definition Of Money Laundering Red Girl Blog Planted Aquarium Aquarium Landscape Aquascape Aquarium

Anti Money Laundering Complaince Training Risk Management University Of Ghana Financial Analyst

1 Dymimic Estimation Of The Amount Of Money Laundering For 20 Highly Download Scientific Diagram

Definition Of Money Laundering Red Girl Blog Iphone Background Wallpaper Iphone Wallpaper Vsco Smartphone Wallpaper

Corruption And Money Laundering The Nexus Way Forward

What Is Money Laundering Amlc Eu

![]()

Money Laundering Fighting A Global Problem From Home

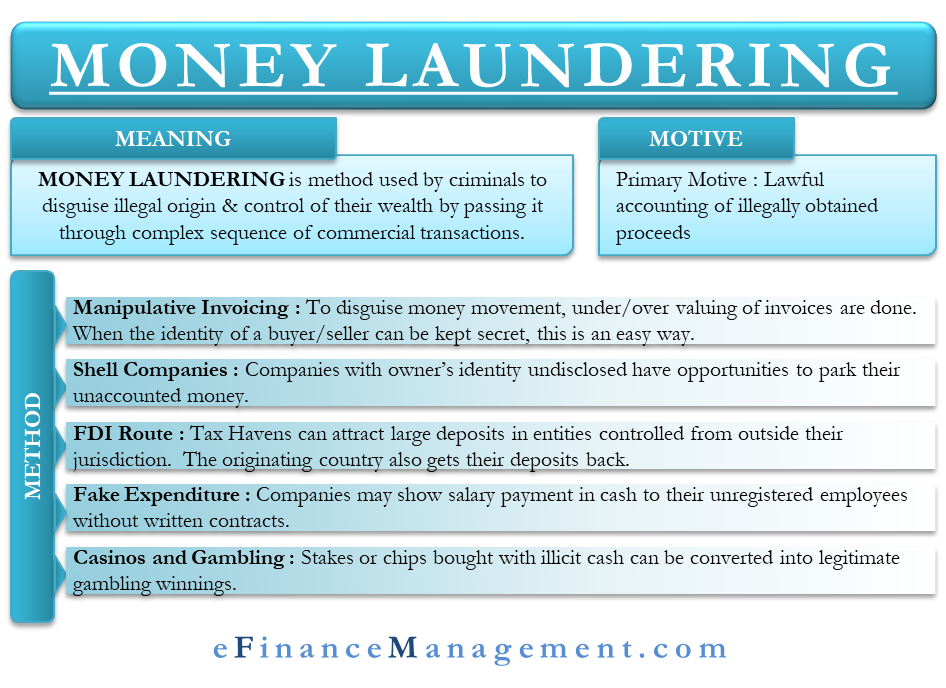

Money Laundering Define Motive Methods Danger Magnitude Control

Understanding Money Laundering European Institute Of Management And Finance

What Is Money Laundering And How Is It Done

What Is Anti Money Laundering Aml Money Laundering Financial Literacy Money

Money Laundering Terrorist Financing Are You Aware Anti Money Laundering Compliance Unit

What Is Money Laundering Financial Crime News

Money Laundering Overview How It Works Example

The world of rules can look like a bowl of alphabet soup at times. US cash laundering rules are not any exception. We have compiled an inventory of the highest ten cash laundering acronyms and their definitions. TMP Risk is consulting firm targeted on protecting monetary companies by decreasing danger, fraud and losses. We've got big bank expertise in operational and regulatory danger. We now have a strong background in program administration, regulatory and operational threat in addition to Lean Six Sigma and Enterprise Process Outsourcing.

Thus money laundering brings many adverse penalties to the group due to the dangers it presents. It will increase the chance of main dangers and the opportunity cost of the bank and finally causes the financial institution to face losses.

Comments

Post a Comment